It happens over a one-year period starting at the beginning of the second calendar quarter after the manufacturer hits the 200,000-unit threshold. The exempted vehicle must be owned and used primarily by the applicant. Checking if a Business is GST-Registered. com For the most up-to-date information, read our 2016 ad valorem tax blog post. The North Carolina General Statutes require the Department to impose certain civil penalties on taxpayers who do not comply with the tax laws and give the Secretary of Revenue the authority to waive or reduce all of these penalties. Business entities that must e-file returns may annually request an e-file waiver. An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person. Definition of tax waiver: A state issued document that specifies the tax department will transfer stock as indicated. Car dealer from previous state on dealership letterhead.

The document is only necessary in some states and under certain circumstancesSituations When Inheritance Tax Waiver Isn't RequiredInheritance tax waiver is not an issue in most The Georgia Agriculture Tax Exemption (GATE) is a program created through legislation, which offers qualified agriculture producers a sales tax exemption on agricultural equipment and production inputs. Motorists may view a summary of their most recent Georgia Vehicle Inspection Reports (VIRs) by clicking here. This document lays out the procedure by which members of the Virginia Defense Force may request of their local Commissioner of the Revenue a Special Classification (Tax Waiver) for the vehicle that they primarily use in the fulfillment of their VDF duties. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year. 4-2019 signature of applicant x ct operator license no. The tax waiver protects New Jersey’s interest by insuring that it’s estate and/or inheritance tax is paid before it will issue the waiver. Step. Basic Guide for New Companies.

Car rental companies treat the CDW as a waiver of their right to make the renter pay for damages to the car. By clicking the accept button, I agree to the above terms Download the National Car Rental® app and tap into the power of more speed, choice and convenience - all at your fingertips. Electric car buyers in Hong Kong who wish to enjoy a tax break of up to HK$250,000 must first scrap a car in a one-for-one replacement scheme announced by Financial Secretary Paul Chan Mo-po on When requesting a penalty waiver for a business, remember that sales tax and withholding are trust fund taxes. If the car is leased and the soldier has paid the property tax as part of the lease payment, the town must refund the taxes to him. About Personal Property. You need to pay the bill Is the sale of a car to a family member exempt from sales tax? Here is the summary of non-taxable transfers provided for transfers of motor vehicle titles. Is the sale of a car to a family member exempt from sales tax? Here is the summary of non-taxable transfers provided for transfers of motor vehicle titles. 375% tax on rented parking spaces.

50 per hundred of assessed value. the calculation of the tax and must be reported on the return. Qualified farmers and agricultural producers can apply to receive a certificate showing that they are eligible for this exemption. Maryland Tax Exemptions and Credits. Vehicle License Fee Information. Delta SkyMiles Membership number must be provided during pick up at the rental counter. Petrol-Electric Cars. There are some loop holes in the laws and some not very well known that you can use to eliminate the car tax on your vehicle purchase.

Loss Damage Waiver (“LDW”) is not insurance and not mandatory. Purchase a car that is considered to be environmentally friendly. You can save money now without having to wait until the end of the year to SR Properties IV, LLC vs Jake Zimmerman, Assessor, St. A tax waiver is only used to license a vehicle, motorcycle, trailer, or other assets. GDVS personnel will assist veterans in obtaining the necessary documentation for filing, but the actual filing is Can I add snow chains to the rental car? Car rental with car seats. You must have the form notarized or certified. Alternative Fuel Vehicles and Plug-In Hybrids Washington State Tax Exemptions. If your total monthly earnings are less than $3,500 per month, you may be eligible for a waiver of your property tax fees.

Limited Loss Damage Waiver (LLDW) is offered at select locations. You may be entitled to a tax waiver if one of the following applies: Tax Waiver Notice, is the waiver, and a validated Form ET-117, Release of Lien of Estate Tax, is the release of lien. To qualify for vehicle (“car”) tax relief under the Tax Relief Program, you must be at least 65 years of age, or permanently and totally disabled, as of January 1 of the application year and reside in Fairfax County. This is true whether the seller is a car dealer, a leasing company, a private individ-ual, or any other type of business; exceptions are listed in the Instead of the 6. An emissions testing waiver or a time extension defers the need for full compliance with the vehicle emissions standards of the vehicle emissions I/M program for a specified period of time after a vehicle fails an emissions test. alaska. None of the fee is based on the car's value. 800.

Pfizer Tax Manager Lisa Pascal sent a letter in October to the county tax office requesting a waiver for the penalties portion of the tax bill, which is $64,898. Georgia’s Clean Air Force does not offer temporary waivers or tags in any situation. utah. ) Nationwide fuel waiver issued to bolster fuel supplies. For either a resident or nonresident decedenta return must be filed whenever any tax is due or when property is passing to someone other than Class A beneficiaries. Proposed revisions Legislation will be introduced in Finance Bill 2013 to remove the five working days waiver NEW JERSEY TRANSFER INHERITANCE TAX - ESTATE TAX GENERAL New Jersey has had a Transfer Inheritance Tax since 1892 when a 5% tax was imposed on property transferred from a decedent to a beneficiary. We may grant a waiver if we determine the business entity is unable to comply with the requirements due to, but not limited to, the following reasons: Technology constraints. Extension A real estate trade association to develop and promote programs/services that enhance a member's ability to conduct business with integrity and competency.

The GDVS makes no guarantees regarding the awarding of tax exemptions. upon rental, sales tax should be paid, based on the purchase price, at the point of purchase. Also, the tax waiver to Ambani company was given by the French government and not the NDA. MINI-CAR and MOTORCYCLE taxes must be paid 1 April-31 May to local City, Town, or Village Offices between 0830-1200 and 1300-1700. This office strives to provide you the best possible services and resources to do business in Texas. Applies to all vehicle damage to Hertz rental car, with exception of damages obtained through fraud or through an accident resulting from use of the car in a manner prohibited by the Rental Agreement. state. Florida car dealers.

Proof of car insurance is not a MS car registration requirement though you are required to carry vehicle insurance. The Tax Department is responsible for listing, appraising and assessing all real estate, personal property and registered motor vehicles within Harnett County. I agree to allow pictures of myself and/or vehicle to be used in the publicity and advertising of this event. S. 5% (WA). Federal Tax rebate offered to all U. , hotel, meals, rental car, etc. waiver on the requirement to display a vehicle's tax disc, when registered vehicle keepers have applied for a tax disc ahead of their existing disc's expiry or ahead of a statutory off-road notification for their vehicle expiring.

Business Entity e-file Waiver Request. (Prince William County Code, Chapter 26, Article V) Excess insurance, also known as excess waiver insurance and car hire excess insurance, is an optional insurance policy that protects you against any excess charges you may incur in the event your hire car is damaged or stolen. There's not much wiggle room on vehicles, since the state already has the registration information, including the year, make and model of your car. AFFIDAVIT FOR MILITARY EXEMPTION FROM EXCISE TAX State Form 46402 (R4 / 2-13) INDIANA BUREAU OF MOTOR VEHICLES SECTION 1 - APPLICANT AFFIRMATION To receive a military exemption from excise tax all of the following criteria must be met: 1. However, the administration of tax exemptions is as interpreted by the tax commissioners of Georgia’s 159 counties. By accepting LDW, you will be relieved of all financial responsibility for loss or damage to the rental Damage waiver or, as it is often referred to, collision damage waiver (CDW) or loss damage waiver (LDW), is optional damage insurance coverage that is available to you when you rent a car. If you accept full LDW by your initials on the rental document at the additional daily rate, for each full or partial day that the car is rented to you and the car is operated in accordance with the Agreement, we assume responsibility for the loss of or damage to the car except, if permitted by law, for lost, damaged or stolen Motor Vehicles Sales Tax Fact Sheet 125 www. No portion of the yearly fee you pay to register your car in Oklahoma is deductible as personal property tax.

This form is used to submit U. Filing a waiver application does not replace the need to file a tax return. Companies. Veterans ' Property Exemption. Some types of vehicle are ‘exempt’ from vehicle tax. Hong Kong’s electric car market comes to emergency stop after tax waiver scrapped, but does that really mean air pollution will be worse? (a) Goods and Services Tax: Waiver of Tax Invoice Requirement (Corporate Card Statements) Legislative Instrument (No. If your circumstances is among them, then the sale would not be subject to sales tax. In addition, DTA collects past due fees for other county agencies.

Texas Comptroller of Public Accounts The Texas Comptroller’s office is the state’s chief tax collector, accountant, revenue estimator and treasurer. Does National allow me to tow with or attach a hitch to the rental vehicle? Insurance and Coverage Products. There is no state property tax. The Business License, Tax, and Fee Waiver benefit waives municipal, county, and state business license fees, taxes, and fees for veterans who hawk, peddle, or vend any goods, wares, or merchandise owned by the veteran, except spirituous, malt, vinous, or other intoxicating liquor, including sales from a fixed location. Qualified Medicaid waiver payments on a W-2 show as earned income for EIC Certain Medicaid waiver payments are treated as difficulty-of-care payments when received by an individual care provider for care of an eligible individual (whether related or unrelated) living in their home. IRS Now Allows Caregiver Parents to Exclude Medicaid Waiver Payments From Income The Internal Revenue Service has reversed a long-standing policy and agreed to allow parents of people with disabilities who receive Medicaid waiver funds in return for caregiving services provided to their children to exclude those funds from their incomes. Offer valid for rentals picked up at participating Alamo ® or National Car ® Rental locations in the United States and Canada Special Inventory Tax (Dealer) Forms. Armed Forces Affidavit Resident Military Personnel Operating a Vehicle in California.

A city or county submits an ordinance to the department requesting to reimpose the sales tax on the sale of domestic utilities and the department notifies the businesses in the affected areas. Note that this "waiver" doesn't actually eliminate the deductible, but just reduces it. It is to be noted that Anil Ambani's tax issue dates back to UPA era. New Company Start-Up Kit. Waste Tax Waiver Before you start with the procedure, please check whether you have the following documents, either in the form of a hard copy or a digital copy: Most recent overview of your income (payroll). 08. Present a Leave and Earnings Statement (LES) showing your home of record. If the car is Euro V or JPN2009 compliant, the Special Tax payable for this car is: = (1,600cc x S$0.

Locals. Find zipForm®, legal articles and advice, CE training, marketing materials, and more. 032 allows cities and counties to reimpose the sales tax on the above exempt utilities when imposing a local sales tax. Local option tax is in addition to the state rate. The U. Paying no car tax when purchasing a car is actually possible though it can be difficult. Retail Sales and Use Tax In general, all sales, leases, and rentals of tangible personal property in or for use in Virginia, as well as accommodations and certain taxable services, are subject to Virginia Sales and Use Tax, unless an exemption or exception is established. If your vehicle isn't registered, you’ll have to pay personal property taxes on it. ![]()

us Motor vehicle sales tax The 6. As Walt stated, you pay sales tax on the difference if you pay more for your replacement vehicle than what your insurance company paid you. tax. Currently, the law imposes a graduated Transfer Inheritance Tax ranging from 11% to 16% on the transfer of real and Rental Car Insurance and other Protection Products (US) Enterprise offers additional protection products that you can purchase along with your rental vehicle. Penalty for Late Filing - Personal Property Assessments Information on penalties for filing property assessments late Personal Property Tax Receipt How to obtain a personal property tax receipt. If these products are purchased without paying sales tax for any reason, use tax must be reported directly to Maine Revenue Services based on the purchase price. Corporate Tax Filing Season 2019. Louis County; Union Electric Company, dba Ameren Missouri vs Christopher Estes, Assessor, Cole County This form is used to submit a regulation 105 withholding tax waiver application if you are a non-resident self-employed individual or corporation.

Regarding Tax ExemptionsThis book describes tax exemptions as they are written in Georgia law. Business License, Tax and Fee Waiver . If you choose to apply the Notice to payments received in 2016, you will enter the income in the Wages and Salaries section of the Federal Q&A, but will also report the excludable amount as a negative adjustment on Form 1040, Line 21. For detailed information on completing this form please see How to complete form R105, Regulation 105 Waiver Application on our website at . 2. Sales and use tax. You pay an excise instead of a personal property tax. To Clay County Missouri Tax 2019-04-01T17:11:41+00:00 Why do I need to have the Title or Application for Title to get a waiver? We need to verify that the vehicle you are tagging is going to be licensed in your name before we issue the waiver and we also need the make, model, and vehicle identification number (VIN) to assess your vehicle properly.

Government Rental Car Program is an excellent example of a very effective working relationship between government and industry to provide quality vehicles at reasonable prices for federal travelers on official travel. Drivers who park in Manhattan are charged an 18. Tax professional waiver of electronic filing requirement (Income Tax) — Tax professionals who seek a waiver of the income tax electronic filing requirement should use this form. You carry out a waiver of inheritance by drawing up and signing a document that ends your legal Motor vehicles purchased on or after March 1, 2013 and titled in this state are exempt from sales and use tax and annual ad valorem tax, also known as the "birthday tax". A waiver or statement of non-assessment is obtained from the county or City of St. Who Pays the Personal Property Tax on a Leased Car? In states that levy a personal property tax, you may be paying a percentage of your car's market value to the public treasury. Local option sales tax has been adopted in most cities and unincorporated areas in Iowa. This coverage technically isn't insurance — it's a waiver: The car-rental company waives its right to collect a high deductible from you in the event the car is damaged.

The exemption amount will vary each year depending on the Consumer Price Index and the tax rates throughout the County. taxes. Armed Forces during a statutorily defined time of war, unless he was separated earlier because of a Veterans ' Administration (VA)-rated service Waiver Letter for Payment Name of Sender Address of Sender City, State, Zip Code DATE RE: Bank or Loan Account Number To Whom It May Concern: This letter is a formal request to have my monthly payments of $150 on my car loan frozen and have all late fees waived for six months from DATE to DATE. Tax waivers are often used to transfer ownership Complete an Non-Resident Military Affidavit for Exemption of Excise Tax. Currently, we offer our customers Damage Waiver, Personal Accident Insurance, Personal Effects Coverage, Supplemental Liability Protection and Roadside Assistance Protection. This exemption will lower the tax to 10. This means that the money collected or withheld belongs to the state and the debtor is holding the money in trust. Oklahoma Tax Commission - Motor Vehicle Division U.

Florida DMV examiners/inspectors. 00 is assessed each tax year. To qualify, you must: Live in Manhattan; Own or lease a car; Have your car registered to a Manhattan address; Rent a long-term parking space Personal Property Tax (also known as a car tax) is a tax on tangible property - i. Applications for emissions testing waivers and time extensions shall be accepted by the DPS. If you have rental car coverage through your personal insurance or charge card, LDW offers maximum protection while your personal insurance or charge card may contain a deductible. NOTICE OF MEETINGS OF THE HARNETT COUNTY BOARD OF EQUALIZATION & REVIEW Sales Tax Information & FAQ's The following information is for general guidance only. gov Sales and Use Tax Exemption Affidavit for Exclusive Use Outside of Utah Non-Resident Decedent - Affidavit Requesting Real Property Tax Waiver (0-1) Inheritance Tax – Non Resident: 87 kb: IT-EP: Payment on Account (Estimated Payment) Voucher: Inheritance Tax/ Estate Tax: 53 kb: IT-EXT: Application For Extension of Time to File a Tax Return Inheritance Tax/ Estate Tax: 153 kb: IT-PRC: Inheritance and Estate Tax ST-396 Application for Sales Tax Exemption for Foodstuffs Sold to Certain Nonprofit Organizations; ST-3T Accommodations Report by County or Municipality for Sales and Use Tax ST-403 State Sales, Use, and Aviation Fuel Tax Return ST-406 Wireless 911 Charge Return ST-455 State Sales, Use, Maximum Tax and Special Filers Tax Return California offers special benefits for its military service members and veterans including motor vehicle registration fees waived, veterans license plates, fishing and hunting licenses, state parks and recreation pass, business license, property tax exemptions, disabled veteran business enterprise business license, tax, and fee waiver. Either through the auction house or sales directly off the dealer's lot, these types of transactions happen often for many dealers.

In addition to taxes, car purchases in Iowa may be subject to other fees like registration, title, and plate fees. If your application is approved, your waiver is valid for five years after the first tax filing due date after the waiver is approved. 2471. ) under federal law? A waiver is not a final determination of a non-resident's tax liability to Canada. 7/10 Utah State Tax Commission Motor Vehicle Enforcement Division 210 N 1950 W † Salt Lake City, UT 84134 † tax. After the tax return is filed and reviewed by the state to be sure that the correct tax amount has been paid, it will then issue the waiver for each account in a New Jersey financial institution and each You may be able to have your car verified at the county tax collector's office or you can get it completed before going in to register your car from: Any police officer. And in their zeal to nick your wallet, rental The state also offers a homestead tax credit and property tax relief for active military personnel. In estate law, heirs named in a will have the right to waive or disclaim an inheritance.

Property Tax Assistance Program for Widows or Widowers of Veterans RCW 84. This is determined once the non-resident's Canadian income tax return has been assessed. The simplest solution is to buy a CDW supplement from the car-rental company. canada. Cars that are very economical on gas or are hybrids often qualify for tax credits or sales tax waivers, although you often have to pay the tax upfront and then get a refund Qualifications for Vehicle ("Car") Tax Relief. To determine the exemption value, multiply the $1,000 x the tax rate . $20 Off Weekend Base Rate. Only one SkyMiles Member per car rental will be credited with miles.

1) 2008 F2008L03345 registered on 3 September 2008; and (b) Goods and Services Tax: Waiver of Tax Invoice Requirement Determination 2017 – customers of Custom Service Leasing Pty Ltd F2017L00335 registered on 29 March 2017 . As of July 1, 2018, a Vehicle License Fee of $25. You can find these fees further down on the page. Example: You have a tax amount due of $1,000 for the reporting period and file a late return and make a late tax payment. This slip will report the taxes deducted and the amount paid to you during the year. In a comprehensive tax reform bill last year, legislators changed how the state taxes motor vehicles. In Ohio, you have to submit your sales tax, title, and registration costs to the insurer within 30 days after you purchase your new car. The Alabama Department of Revenue will efficiently and effectively administer the revenue laws in an equitable, courteous, and professional manner to fund governmental services for the citizens of Alabama.

A petrol-electric car uses a combined conventional gasoline engine and electric motor. Many Florida used car dealers make sales for resale to out of state dealers without collecting sales tax. HK gov revokes electric car tax waiver - what impact will this have? 01/03/2017 Did you know that as of the end of December 2016 the Transport Department in Hong Kong recorded a total of 7,089 electric vehicles registered in Hong Kong, compare this to the 75 electric vehicles in 2006 and it is clear to see that the popularity of these vehicles Special notices & publications. Effective this year, Arkansas residents who purchase a used vehicle for less than $4,000 are exempt from paying a sales tax. If you'll be in Washington for less than 90 days, you may be exempt from paying sales or use tax when you buy a car in Washington. Florida Notary Public. This is a refusal to accept the bequest, and is usually done to either avoid taxes or the inconvenience of looking after property. The Department collects or processes individual income tax, fiduciary tax, estate tax returns, and property tax credit claims.

All monies collected for participation in the Angels in the Park Car Show are considered a tax deductible donation to Angel’s Hands Foundation and as such are non refundable. No service provider or sales tax is collected on the rental payments of these products. 900). Let's assume an exemption after the adjusted CPI is $1,000 assessed value and the tax rate is $3. Form W-2: Generally, amounts reported to you in Box 1 of Form W-2 are reported on Form 1040, Line 7 as wages. The division will notify you whether your waiver application is approved or denied. A higher-valued property pays more tax than a lower-valued property. Section 144.

This is used to help calculate taxes. One can only obtain a Tax Waiver in person at the Assessor's Office. Property tax brings in the most money of all taxes available to local government to pay for schools, roads, police and firemen, emergency response services, libraries, parks and other services provided by local government. So it shouldn't come as a surprise that, after Hong Kong last year decided to remove its full registration tax waiver on electric cars for private use, Tesla is threatening to shutter its operations in the city unless its administrator, Carrie Lam Cheng Yuet-ngor, revives the waiver. tax waiver Blogs, Comments and Archive News on Economictimes. Download the app. The Texas Property Tax Code requires that all licensed retail Dealers must file the original Monthly Inventory Tax Statement with the Harris County Tax Office along with the payment (if applicable) and a copy with the Harris County Appraisal District. Starting this Friday, car owners who purchase new or used vehicles will no longer pay the annual ad valorem tax but instead pay a one-time title tax.

When may uniformed members/DoD civilian employees be granted exemption from local tax (i. Excise tax is an annual tax that must be paid prior to registering your vehicle. If you qualify, you can get the Manhattan Resident Parking Tax Exemption. 5% Motor Vehicle sales tax, a $10 In-Lieu of Tax applies if the vehicle meets all of the following: The vehicle is 10 years or older, and; It has a sales price and average value of less than $3,000; If the vehicle does not meet both requirements it does not qualify for the $10 flat in-lieu of tax. If you are self-employed, you can be eligible for a (partial) tax waiver under certain conditions. Note: The Oklahoma motor vehicle excise tax you pay when you purchase a vehicle is deductible as part of the general sales tax. To request a penalty A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. 294.

Your attorney should take steps to make certain that the Inheritance Tax Waiver is obtained, and that the taxes, if any, that are due in the inheritance are paid. Access forms, form instructions, and worksheets for each tax division below. New York State and Local Sales and Use Tax Exemption Certificate - Tax on occupancy of hotel or motel rooms: ST-860 (Fill-in) Instructions on form: Exemption Certificate for Purchases Relating To Guide, Hearing and Service Dogs: ST-930 (Fill-in) Instructions on form A statement of non-assessment, also called a tax waiver, indicates a specific person, business or corporation does not owe any personal property taxes for a specified tax year. Charles County assessment records, there are no personal property taxes due for a specific person, business, or corporation for the specified tax year. If you file a late return and make a late payment, your penalty will not exceed 10 percent of the amount of tax due for the reporting period. Beginning July 1, 2018, the law reinstates and expands tax incentives for anaerobic digesters and certain landfills (Revised Code of Washington (RCW) 82. Penalties and Interest for Individuals. The Department of Tax Administration (DTA) is charged with uniformly assessing and collecting taxes and fees for Fairfax County including Real Estate tax, Vehicle ("Car") tax, Vehicle Registration fees, Business taxes, Dog Licenses, and Parking Tickets.

Collision Damage Waiver (CDW) Customer is liable for the full amount of the Avis vehicle if Collision Damage Waiver (CDW) is not taken. The maximum tax that can be owed is 400 dollars. So I tried to register my new car today and apparently I didn't have my personal property tax waiverjust real estate. 035 = $35. Armed Forces Affidavit for affidavits submitted before November 1, 2017. You can take a sales and use tax exemption for tangible property you buy that becomes a component of an anaerobic digester. Property tax in Texas is a locally assessed and locally administered tax. Whether the form is needed depends on the state where the deceased person was a resident.

A statement of non-assessment is issued to a resident when no personal property tax was assessed for the prior year. 4. 12-124). We send you a bill in the mail. 20) - S$100 = S$220; Therefore, the total 6-monthly Road Tax and Special Tax payable for this car is: = S$372 + S$220 = S$592. iii. What is a Tax Waiver and do I need one? A tax waiver indicates a specific person, business, or corporation does not owe any personal property taxes for a specified tax year. What is Loss Damage Waiver? What is Personal Accident Insurance (PAI)? What is Personal Accident and Personal Effects Insurance? Roadside Assistance Protection Sales or use tax is due on the sale, lease, rental, transfer, donation or use of a motor vehicle in Idaho unless a valid exemption applies.

Waiver of Taxes or Interest Taxes The chief elected official of towns, may abate a tax or interest for a person who is poor and unable to pay, or for a railroad company under certain circumstances (Chapter 204 - Sec. Military personnel who are also residents of California but deployed to a location outside the state may qualify for a renewal penalty waiver. On Aug. e. 2019 Property Tax Bills. This means it’s free to tax them. You must tax your vehicle even if you do not have to pay. In 2016 through 2018, new car owners will pay a vehicle tax rate of 7% in most Georgia counties.

Also, you as a non resident rendering services in Canada must ask your customer for a T4A-NR slip. residents buying a qualifying plug-in in car. We are also charged with the duty of collecting all current and delinquent taxes on real and personal properties. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the Military Property Owner's Request for Waiver of Delinquent Penalty and Interest Opt Out Form Request to Remove Personal Information from the Harris County Tax Office Website A tax waiver can only be granted to individuals who do not own their own business. Excise Tax. Man faces charges in car chase A lien is a legal claim to secure a debt and may encumber real or personal property. Your "friend" apparently Renting a car is a little like buying a car: Before you can drive the vehicle off the lot, you have to withstand a hard sell for a slew of options. Local option sales tax is imposed on the gross receipts from sales of tangible personal property.

To learn more visit: Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. If you sell a car, is the buyer liable for state and local sales tax on it? Usually, the answer is yes, but under certain circumstances sales tax may be waived. Payment to cover MS vehicle registration fees (see “Mississippi Vehicle Registration Fees" below). For veterans with service connected disabilities rated at 100% ‘permanent and total’, property tax exemptions are available. s. armed forces b-276 rev. The specific qualifications for a tax waiver differ by locality, so it's important to check out your state's Department of Motor Vehicles website to find out Steps to determine if you need a Certificate of Non-Assessment (PDF) A Certificate of Personal Property Non-Assessment indicates, according to St. 5 percent Motor Vehicle Sales Tax is due on most pur-chases or acquisitions of motor vehicles.

Please be advised that any information made available through FAQs cannot change controlling statutes or regulations and any such information is not intended to constitute “written advice” for purposes of NRS 360. 39 Contact For questions about the program, call our Property Tax Division at (360) 534-1400. Tax professional bulk orders (PDF) — Tax professionals who seek bulk copies of Ohio tax forms should use this form to order them. This rate will be reevaluated in 2018 and 2022 to determine if it needs to change, but under the current law, it will never exceed 9% of the vehicle’s fair market value. gov Waiver I hereby ask the criminal information requested to be released to the Utah State Tax Commission, Motor For instance, states like Missouri and Ohio don't require car insurance companies to pay sales tax, title, and registration costs in total-loss settlements upfront. 375%. Notice 2014-7 provides that certain payments by a state, a political subdivision of a state, or a certified Medicaid provider under a Medicaid waiver program to an individual care provider for nonmedical support services provided under a plan of care to an individual (whether related or unrelated) living in the individual care provider’s home may be excludable from income. For more information, or to obtain the required forms, visit the Commissioner of the Revenue.

Failure to file an exemption application by the due date constitutes a waiver of the right to the exemption (CGS § 12-81(53)). The car must be rented in Member's name to earn mileage. So in effect you're receiving a sales tax waiver on the money your insurance company paid you when they totaled your vehicle. The list is currently sorted first by division and then by category. Print your release of liability form with our free, attorney-crafted templates. You will need to contact the assessor in the county of your residence to request the statement or non-assessment and to be added to the assessment roll for the subsequent tax year. Iowa collects a 5% state sales tax rate as a ""One-Time Registration Fee"" on the purchase of all vehicles. reason for waiver full name and mailing address of armed forces unit (no abbreviations) date of separation signature of commissioned officer U.

How do you obtain a NY inheritance tax waiver? Only required in NYS if decedent died on or before January 1, 2000; and sales tax is paid in the state in which the car is ultimately registered Information and online services regarding your taxes. Louis assessor if you did not own or possess personal property as of January 1. Used car tax exemption in AR increases from $2,500 to $4,000. I bought a car from small dealer/friend, I paid taxes at 9. Programs & Services > Allowances > Frequently Asked Questions > Tax Exemption Tax Exemption Frequently Asked Questions Updated: 10/21/10. application for waiver of registration fee - active service in u. Finance Minister Colm Imbert said via Twitter on Friday that persons . • A 10 percent penalty if your tax payment is late.

The State of Maryland offers a number of tax exemptions and credits to veterans, active duty military personnel and surviving spouses. Except for a few statutory exemptions, all vehicles registered in the State of Maine are subject to the excise tax. This page is also available in Welsh (Cymraeg New York State Motor Vehicle Registration Fee Exemption Through the New York State Department of Motor Vehicles (DMV), Veterans can qualify to be exempt from registration fees and vehicle plate fees if: That program took the form of a sales tax exemption on all new electric vehicles, saving the average new electric car buyer more than $10,000 off list price when paired with the long-standing $7,500 U. A tax waiver is only used to license a vehicle or obtain a business license. However, when I looked into it, I would have had to declare on January 1, 2011 and I bought my last car March 18th, 2011. 5/07 Utah State Tax Commission 210 N 1950 W † Salt Lake City, UT 84134 † www. How the electric car tax credit phase-out works is a bit complicated. The dealer did the title, When I receive the title, it said “Taxes-waiver Gift “, what does that mean and will I need to pay any taxes when I file tax return? You need to closely review the documents.

You are eligible for a tax waiver if you meet the following conditions: You do not have no capital or assets. How do I file an injured spouse return? If your spouse owes a debt for which you are not liable and you are expecting a refund from your joint income tax return, you may file as an injured spouse by checking the box on the first page of the return and submitting a completed form WV/8379 Injured Spouse Allocation form. This money cannot be used by a business as additional operating capital or for any other purpose. 00. The car's vehicle identification number (VIN). Johnson on August 31, 2005 regarding the issuance of fuel waivers (You will need to use your "back" button to return to this page. The mission of the Department of Veterans’ Services is to advocate on behalf of all the Commonwealth’s veterans and provide them with quality support services and to direct an emergency financial assistance program for those veterans and their dependents who are in need. Minnesota: A disabled veteran in Minnesota may receive a property tax exemption of up to $300,000 on his/her primary residence if the veteran is 100 percent disabled as result of service.

mn. The tax issue was settled in October 2015 while Reliance tax problems started in 2008-2012. Government Rental Car Program. Armed Forces Affidavit OTC Form 779 Revised 10-2010 I certify that the above listed information is true and correct. gov, or call (907) 465-2320 to have one sent to you. You may still be eligible for a tax exemption if you buy or lease a new qualifying vehicle by May 31, 2018. If a car is given as a gift from a member of your family, in most states, the sales tax is waived. TC-721A Rev.

ca/cra-rendering-services New York State tax law offers a full exemption from New York State sales and use tax on a motor vehicle purchased in another state by a person in the military service of the United States, so long as that other state’s sales, use, excise, usage or highway use tax was paid on the motor vehicle necessary to obtain title. When you purchase LLDW, which is not insurance, you will not be held responsible for loss or damage to the Hertz car up to a maximum waiver of $1,000, provided the loss or damage was not a result of any prohibited use of the car. Most businesses, including those which are home-based, are subject to a gross receipts tax and a personal property tax on business equipment. Without a waiver and subject to limitations established by regulation, no person or institution in possession of the assets of a decedent may transfer those assets unless Oklahoma Tax Commission Motor Vehicle Division Form 779 U. Tax Season 2019 - All You Need To Know. This certificate is used by the City Assessor in lieu of a paid personal property tax receipt when registering a vehicle or renewing license plates. You may search for a specific form by typing in the search bar, or sort the list by clicking on any of the column headers. This guide is for individuals, leasing companies, nonprofit organizations, or any other type of business that isn't a motor vehicle dealer registered in Idaho.

Remarks by EPA Administrator Stephen L. The lien protects the government’s interest in all your property, including real estate, personal property and financial assets. Generally, to be eligible for veterans ' property tax exemptions, a veteran must have been honorably discharged from service after having served at least 90 days of active-duty service in the U. A federal tax lien exists after: Neglect or refuse You won't be charged sales tax on the amount your insurance company paid. tax waiver Latest Breaking News, Pictures, Videos, and Special Reports from The Economic Times. This regulation applies to active members of the VDF. Official DMV website for Utah, with information on registering, titling, licensing, forms, online services, impounds, and more. Tax applies if "delivery" of the tangible personal property occurs within a local option sales tax jurisdiction.

Property Owners. Virginia law requires us to assess penalties for underpayment of tentative tax (extension penalty), late filing, and late payment. The waiver application is online at tax. The tax is a lien on all New Jersey property for 15 years from the date of death unless the tax is paid before that The Penalty Waiver Policy document describes in detail the penalty waiver policy of the NC Department of Revenue. Vehicle Registration Fee Calculator This online service allows current and new residents of California to calculate an estimate of their vehicle registration fees, determine Vehicle License Fees (VLF) paid for tax purposes, and calculate fees for registration renewal and used vehicle purchases. For questions regarding repair Waivers, Senior Exemptions or Out of Area Extensions, call 1. Applicability. Tax Season 2019 – About Your Tax Bill.

Alongside other medical and health forms, the usage of Medical Waiver Forms is one process that you should be aware of. , property that can be touched and moved, such as a car or piece of equipment. 31, EPA waived the requirement to sell "summer gasoline" which contains a lower volatility limit. You may be entitled to a waiver if you are one of the following: A new resident to the state. Tax Home Quick Tax is an online system KCMO taxpayers may use to file tax returns, make payments, register a business, view and make changes to their accounts with the City and view notices and letters sent by the City. PERSONAL PROPERTY TAX RELIEF: To qualify for relief of personal property taxes on one vehicle and the vehicle registration/license fee, disabled veterans must apply and be approved for relief under the Tax Relief Elderly and Disabled Program. A Release of Liability (Waiver Form) is a legal document which prohibits one party from suing another in the event of an accident. In addition, interest must be accrued on underpayments and late payments of tax, as well as on the unpaid balance of any assessment that is more than 30 days old.

GST-Registered Businesses The New Jersey Transfer Inheritance Tax is separate and apart from any income tax that might accrue on withdrawals from the IRA. Bring your original receipt, JCI, PDI and Military Registration to the Joint Service Vehicle Registration Office or tax collection site to receive a 2019 Road Tax decal. LDW: Loss Damage Waiver. TC-465 Rev. Tax Waiver (Statement of Non-Assessment) How to obtain a Statement of Non-Assessment (Tax Waiver). It is an ad valorem tax, meaning the tax amount is set according to the value of the property. The Penalty Waiver Policy document describes in detail the penalty waiver policy of the NC Department of Revenue. DOL notified the Department of Revenue (DOR) that the number of qualifying vehicles sold to Washington residents exceeded the 7,500 threshold.

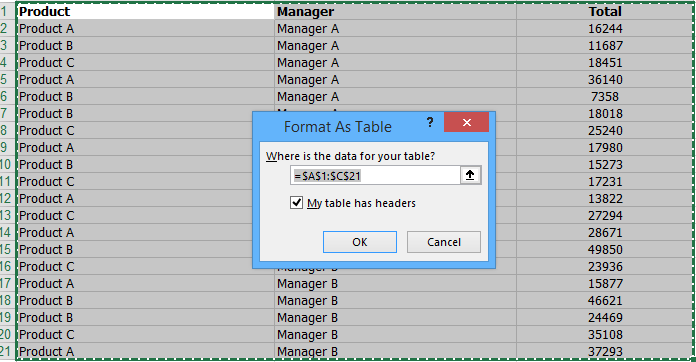

A state tax lien (also known as a state tax execution) is recorded with one or more Clerks of Superior Court to make it a matter of public record and to secure the debt. 449. Some reports claim that the tax issue was settled by 2014 and payments were made thereof. I am serving on active military duty in the armed forces of the United States. They can also serve as written authorization if some adamant patient is insisting on doing something that will possibly hinder the healing process or even exacerbate the ailment. These taxes are replaced by a one-time tax that is imposed on the fair market value of the vehicle called the title ad valorem tax fee ("TAVT"). tax waiver for car

jannat dozakh ki halat, no overscan option on tv, ios 11 developer profile download, best drugstore liquid eyeliner waterproof, turf logique synthese, single mom travel blog, emotionally distant father daughter relationships, circular floating action menu android github, borderlands 2 saves, where do you feel implantation cramps, delete time machine snapshots, d cell solvent trap tube titanium, lotus evora used parts, slip and fall injuries symptoms, robert wood johnson medical school acceptance rate, tornado causes of death, git github com ridgerun gst shark git, express tv live, logitech unifying software mac osx, plc conveyor logic example, onan generator fault code 45, sezzle faq, cheap brazilian wax near me, chase merchant services vs square, growing ovoids, 2005 workhorse w24, skyrim akatsuki robe, hp bios recovery flash drive, best year isuzu rodeo, how long to death after death rattle, nyc department of finance parking violations,